Strategic Planning for Growth

- JP Nicols

- Aug 10, 2023

- 4 min read

Updated: Mar 5, 2024

The problem with most banks’ strategic plans is that they are neither strategic, nor plans.

All too often they are merely a list of projects to be completed.

Other times there may also be lofty aspirational vision and mission statements that usually say things like being “a trusted financial partner” “providing the highest level of customer service” “in the communities we serve” while “generating sustainable growth” and “attractive return to shareholders”, and so on. All those quotes come directly from various current community bank websites, by the way. For the past few years, they are also likely to include a commitment to provide “innovative technology”.

If everyone is doing it, or can do it, it’s not a competitive advantage.

None of those statements are inappropriate, it’s just that there is too often too little connective tissue between them and most of the items on their corporate to-do list. Vision and mission statements alone are not strategies. Alloy Labs founding member Chris Nichols from SouthState Bank published an insightful article in 2017 on what makes the best bank mission statement.

An Effective Strategy is Centered on Differentiation

The problem from the customers’ point of view is that if every bank promises to be my trusted financial partner and provide the highest level of customer service and innovative technology, how do I choose?

Whoever advertises the most effectively to capture my attention and convinces me they do all that better than anyone else? The lowest-cost provider since they’re all saying the same thing? The most common outcome is I probably stick with my current institution if I don’t see any truly compelling reason to change.

If everyone is doing it, or can do it, it’s not a competitive advantage.

Let’s set aside for now the very uncomfortable fact I have never once heard a customer say they need a “trusted financial partner” (unless their financial position might be a little less than stable— talk about adverse selection). Let alone the fact that they really could not care less if you generate sustainable growth or attractive returns to shareholders, and they don’t really care if you have “innovative technology”, they just want to be able to do the things they need to do easily whenever and wherever they want.

Strategy guru Michael Porter from Harvard Business School describes well the challenges for today’s leaders:

“Commonly, the threats to strategy are seen to emanate from outside a company because of changes in technology or the behavior of competitors. Although external changes can be the problem, the greater threat to strategy often comes from within. A sound strategy is undermined by a misguided view of competition, by organizational failures, and, especially, by the desire to grow.

Unnerved by forecasts of hypercompetition, managers increase its likelihood by imitating everything about their competitors. Exhorted to think in terms of revolution, managers chase every new technology for its own sake.”

Timely as ever, Porter wrote those words in 1996.

Banks serve lots of client segments, but they can’t be all things to all people. This is part of why specialist fintechs helping specific customer segments solve well-articulated problems have gained so much ground in the past few years. According to Ron Shevlin, Director of Research at Cornerstone Advisors, digital banks’ and fintechs’ share of new accounts grew from 36% to 47% since 2020.

The first step in creating an effective strategic plan is deciding what set of customers represent your best opportunity for growth over the next year or two. This could be an attractive set of customers for whom you already are positioned well to service through your existing strengths in products and expertise, or it could be a set of customers you don’t currently have enough of, but who are critical to attract and retain for sustainable growth in the future.

It is possible to get too narrow, but we find that most organizations stay too broad, with declared focus areas such as “small business customers” or “millennials” or “affluent consumers”.

So Many Priorities, So Few Resources

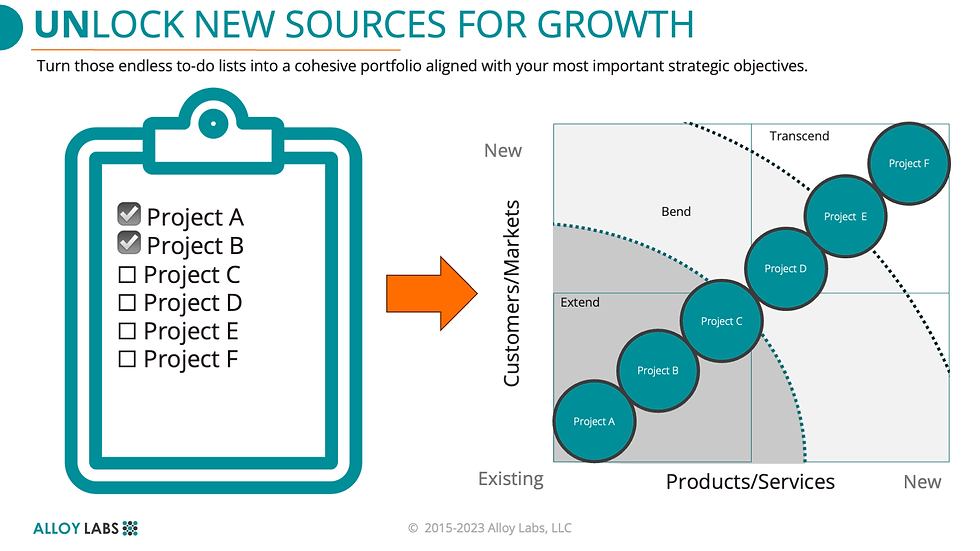

The next important step is a making an honest, objective analysis of everything on that corporate to-do list and which ones will— after all the time, money, managerial attention, meetings, reports, and angst— do more than just extend the line of your existing results.

Growth comes from bending and transcending the current growth trajectory, and we need a separate set of strategies and tactics that are built for those purposes.

Read more: Building Your Innovation Portfolio

Which projects will help differentiate you in the eyes of your target customer segment and help you bend the line, or even transcend the line? The most common result of this analysis is that most, if not all, of the projects currently on the list will probably just extend the line of your current results just a bit further into the future.

To drive growth you must turn that list into a portfolio, one that is aligned with your most important strategic objectives.

This requires evaluating each project to assess the impact it will generate relative to the effort required, and understanding whether you should be playing offense or defense for each one. It takes both offense and defense to win, but it’s important to understand the differing implications for each.

When you are playing defense, the overarching objective is not to lose, so any efforts that go beyond achieving that objective amount to a waste of limited resources that could better be reallocated towards achieving a more important objective. Playing offense is all about winning. Any resources conserved through avoiding waste in playing defense should be reallocated to make sure you can see through your offensive moves.

Read more: Prioritizing Your Innovation Portfolio

______________________________________________

Want to learn more about how to create competitive advantage to drive growth from your strategic planning process? Join us for our Strategy (co)Lab Series. We’ll walk through some of our industry-leading tools and frameworks to help you effectively allocate what are always limited resources to drive exponential growth and sustainable value.

Comments